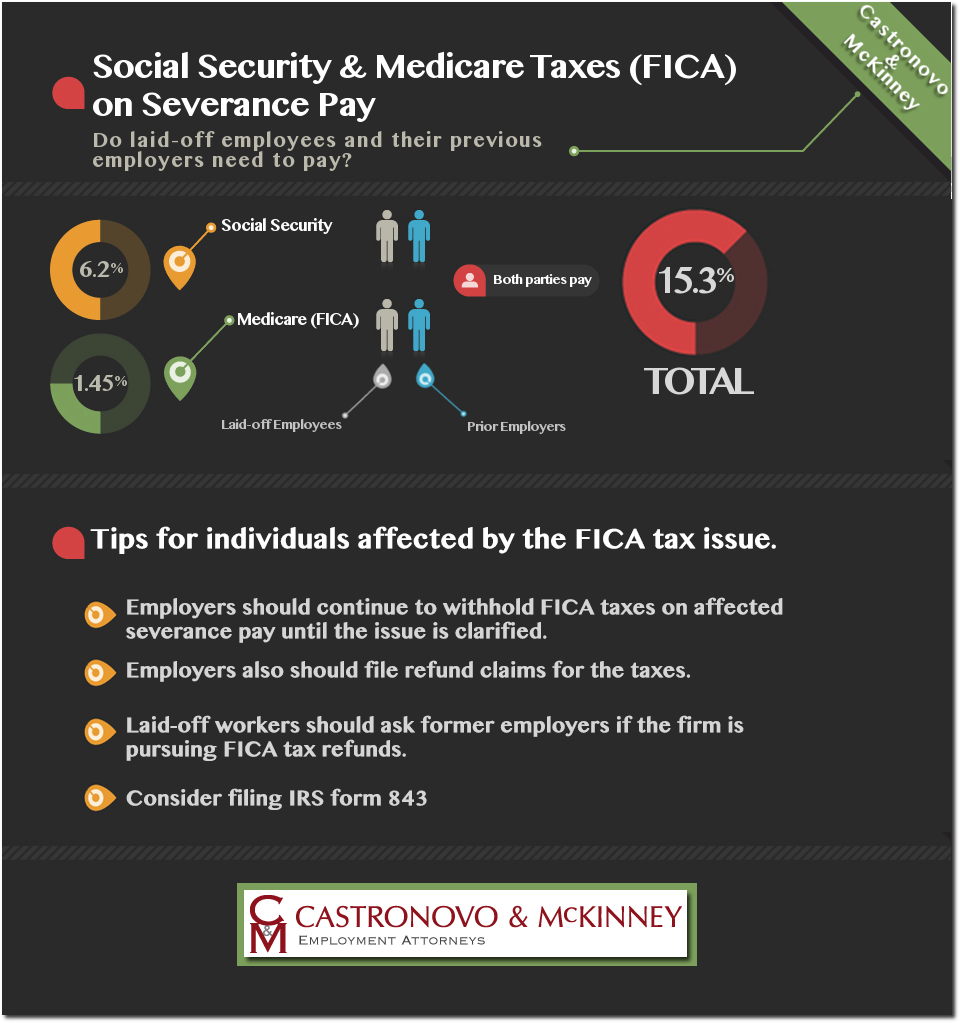

Do I Owe Payroll Taxes on Severance Pay? Do laid-off employees and their previous employers need to pay Social Security and Medicare taxes (FICA) on severance pay?

Do I Owe Payroll Taxes on Severance Pay? This is a huge issue right now for both companies and taxpayers alike as two federal courts disagree on the answer and several billions of dollars hangs in the decision. Typically both parties owe FICA taxes on wages. This is comprised of a Social Security Tax of 6.2% up to $110,000 plus a Medicare tax of 1.45% on wages for a total of 15.3%. As an example say an employee receives 100,000 of severance pay. If the law changes the employer and employee would be required to split the FICA taxes of about $15,000.

Legal experts say the issue could end up before the U.S. Supreme Court unless the Sixth Circuit grants a rehearing of Quality Stores, requested by the U.S., and then reverses its September decision. The petition to rehear was filed earlier this month but the the Sixth Circuit judges haven’t yet ruled. On September 7, 2012, the Sixth Circuit affirmed the Western District Court of Michigan’s holding in U.S. v. Quality Stores Inc., that severance payments made to employees pursuant to an involuntary reduction in force were not “wages” for FICA tax purposes.

You should reach out to a New York Severance Attorneys to protect your rights and know your legal standing. Contact us today!

Do I Owe Payroll Taxes on Severance Pay? Here are several tips for employers and employees affected by the FICA tax issue.

• Employers should continue to withhold FICA taxes on affected severance pay until the issue is clarified.

• Employers also should file refund claims for the taxes. The filing needs to be made with the Internal Revenue Service within three years of the April 15 due date following the calendar year of the severance payment, which is the statute of limitations period. This preserves the right to benefit from a favorable court decision in the future.

• Prepare to contest further. If the IRS explicitly denies the refund claim, the employer should file a “refund action” in U.S. District Court or the U.S. Court of Federal Claims within two years of the denial. This filing also preserves firms’ rights to benefit from a favorable decision.

• Laid-off workers should ask former employers if the firm is pursuing FICA tax refunds. While the company might alert former workers that it is doing so, it doesn’t have to inform them until the IRS agrees to the claim. At that point, the employer completes the claim by asking each former worker for consent to include the worker’s claim with its own. This process prevents the firm from collecting money owed to the worker without his knowledge. The company also has to distribute to each former worker his share of refunded tax when the IRS pays it.

• Consider other steps. If the company didn’t file a refund claim for FICA taxes but the employee believes she is entitled to one, then often she can file IRS form 843 to make her own claim, according to an IRS spokesman. But the worker must make the claim during the statute of limitations period, which is usually three years after the April 15 due date following the year the severance was received.